MUH 210 | Course Introduction and Application Information

| Course Name |

Accounting for Foreign Trade Transactions

|

|

Code

|

Semester

|

Theory

(hour/week) |

Application/Lab

(hour/week) |

Local Credits

|

ECTS

|

|

MUH 210

|

Fall/Spring

|

3

|

0

|

3

|

3

|

| Prerequisites |

None

|

|||||

| Course Language |

Turkish

|

|||||

| Course Type |

Elective

|

|||||

| Course Level |

Short Cycle

|

|||||

| Mode of Delivery | face to face | |||||

| Teaching Methods and Techniques of the Course | Lecture / Presentation | |||||

| National Occupation Classification | - | |||||

| Course Coordinator | ||||||

| Course Lecturer(s) | - | |||||

| Assistant(s) | - | |||||

| Course Objectives | The aim of this course is to examine the processes that occur during the foreign trade operations and to perform the necessary accounting records. |

| Learning Outcomes |

The students who succeeded in this course;

|

| Course Description | This course covers subjects as accounting records of import and export transactions, accounting records for VAT Applications resulting from import and export transactions, accounting records of foreign currency transactions and letter of credit transactions. |

| Related Sustainable Development Goals |

|

|

Core Courses | |

| Major Area Courses | ||

| Supportive Courses |

X

|

|

| Media and Management Skills Courses | ||

| Transferable Skill Courses |

WEEKLY SUBJECTS AND RELATED PREPARATION STUDIES

| Week | Subjects | Related Preparation |

| 1 | Introduction to Foreign Trade Transactions | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. Chapter 1. |

| 2 | Import and Export Operations | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. Chapter 2. |

| 3 | Import and Export Process | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. Chapter 3. |

| 4 | Customs Regimes | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. Chapter 4. |

| 5 | Foreign Exchange Legislation | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. Chapter 5. |

| 6 | Delivery Types | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. Chapter 6. |

| 7 | Payment methods | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. Chapter 7. |

| 8 | MID TERM EXAM | Ara Sınav |

| 9 | VAT Transactions in Foreign Trade | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. Chapter 8. |

| 10 | Accounting of Foreign Trade Transactions | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. Chapter 9. |

| 11 | Accounting of Foreign Trade Transactions | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. Chapter 10. |

| 12 | Accounting of Foreign Trade Transactions | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. Chapter 10. |

| 13 | Accounting of Foreign Trade Transactions | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. Chapter 11. |

| 14 | Accounting of Foreign Trade Transactions | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. Chapter 11. |

| 15 | Accounting of Foreign Trade Transactions | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. Chapter 12. |

| 16 | FINAL | FINAL |

| Course Notes/Textbooks | Dış Ticaret İşlemleri İçin Muhasebe Uygulamaları, Fatih Uzun, Serhat Yanık, Türkmen Kitabevi, 2017, ISBN: 9757337539. |

| Suggested Readings/Materials | - |

EVALUATION SYSTEM

| Semester Activities | Number | Weigthing |

| Participation |

1

|

10

|

| Laboratory / Application | ||

| Field Work | ||

| Quizzes / Studio Critiques | ||

| Portfolio | ||

| Homework / Assignments |

1

|

20

|

| Presentation / Jury | ||

| Project | ||

| Seminar / Workshop | ||

| Oral Exams | ||

| Midterm |

1

|

30

|

| Final Exam |

1

|

40

|

| Total |

| Weighting of Semester Activities on the Final Grade |

3

|

60

|

| Weighting of End-of-Semester Activities on the Final Grade |

1

|

40

|

| Total |

ECTS / WORKLOAD TABLE

| Semester Activities | Number | Duration (Hours) | Workload |

|---|---|---|---|

| Theoretical Course Hours (Including exam week: 16 x total hours) |

16

|

3

|

48

|

| Laboratory / Application Hours (Including exam week: '.16.' x total hours) |

16

|

0

|

|

| Study Hours Out of Class |

0

|

||

| Field Work |

0

|

||

| Quizzes / Studio Critiques |

0

|

||

| Portfolio |

0

|

||

| Homework / Assignments |

1

|

10

|

10

|

| Presentation / Jury |

0

|

||

| Project |

0

|

||

| Seminar / Workshop |

0

|

||

| Oral Exam |

0

|

||

| Midterms |

1

|

20

|

20

|

| Final Exam |

1

|

20

|

20

|

| Total |

98

|

COURSE LEARNING OUTCOMES AND PROGRAM QUALIFICATIONS RELATIONSHIP

|

#

|

Program Competencies/Outcomes |

* Contribution Level

|

|||||

|

1

|

2

|

3

|

4

|

5

|

|||

| 1 |

To be able to explain the scope, importance and functions of the accounting process |

-

|

X

|

-

|

-

|

-

|

|

| 2 |

To be able to recognize regulatory and supervisory agencies together with relevant and competent stakeholders in the field of accounting |

-

|

X

|

-

|

-

|

-

|

|

| 3 |

To be able to register, correct and close the financial transactions in the related accounting records within the accounting cycle |

-

|

-

|

X

|

-

|

-

|

|

| 4 |

To be able to analyze the financial statements like balance sheet and income statement |

-

|

-

|

-

|

-

|

-

|

|

| 5 |

To be able to use computer related software programs and field related computer applications |

-

|

-

|

-

|

-

|

-

|

|

| 6 |

To be able to recognize, organize, store the documents used in commercial life and to be able gain skills in office layout, archiving and personnel management |

-

|

-

|

X

|

-

|

-

|

|

| 7 |

To have the general knowledge about laws and specific legislation about taxes, social security, capital markets and foreign exchange |

-

|

-

|

-

|

-

|

-

|

|

| 8 |

To be able to explain the economic situatons by analyzing the concepts of the economic, the general functioning of the system and the relationship between the elements of the system and the economic phenomena |

-

|

-

|

-

|

-

|

-

|

|

| 9 |

To be able to develop the analytical thinking skills required for the solution of professional problems and applies the rules of mathematics and logic |

-

|

-

|

-

|

-

|

-

|

|

| 10 |

To be able to use the english at the general level of European Language Portfolio A2 to communicate effectively with his / her colleagues and to follow up necessary professional sources in his/her field |

-

|

-

|

-

|

-

|

-

|

|

| 11 |

To be able to make decisions based on the principles of professional ethics, accountability and responsibility |

-

|

-

|

-

|

-

|

-

|

|

| 12 |

To have the ability to work effectively in individual and multi-disciplinary teams and to use them in their work environment |

-

|

-

|

-

|

-

|

-

|

|

| 13 |

To have a broad perspective on social and academic aspects by closely following the developments in various different subjects in or out of the scope of his/her profession |

-

|

-

|

-

|

-

|

-

|

|

*1 Lowest, 2 Low, 3 Average, 4 High, 5 Highest

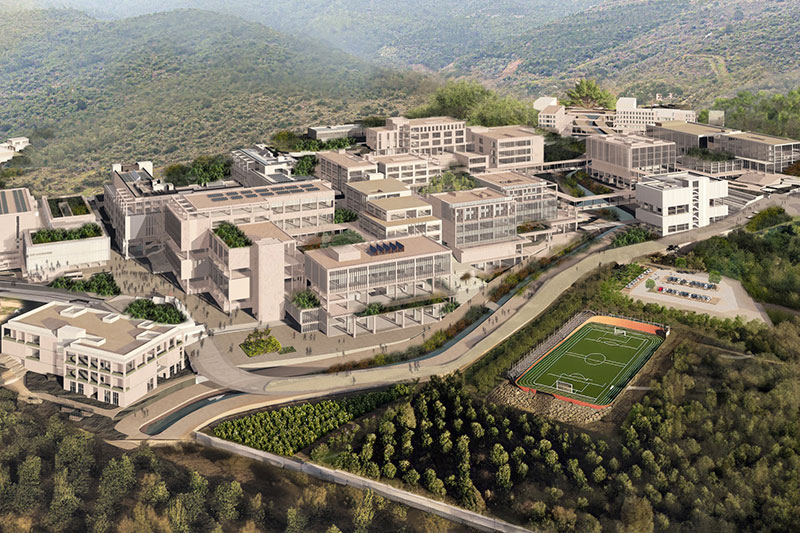

IZMIR UNIVERSITY OF ECONOMICS GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..