Courses

This is a compulsory English course which provides basic language skills such as reading, writing, listening and speaking at the beginning level.

Students will be able to explain the main principles of accounting, applying the rules and principles of accounting, they will be able to manage accounting entries and prepare the accounting ledgers and the balance sheet for the end of the period.

This course provides a general information of the events from the end of the 19. century until the end of the Turkish War of Independence and the signing of the Treaty of Lausanne in 1923.

The student will be able to express the basic concepts of economics, apply economic analysis methods and analyze the features of economic systems.

The course will help students recognize the skills necessary for university life and personal development. These skills include self-awareness, goal setting, time management, effective communication, mindfulness, and analytical thinking. The course will also raise students' awareness of the habits essential for physical, mental, and spiritual health, as well as issues such as addiction and bullying.

The fundamental topics of law are: rules of social order, sources of law, branches of law, judicial organization, types of lawsuits, application of legal rules, and basic legal concepts.

Students will be taught how to use the written communication tools accurately and efficiently in this course. Various types of written statements will be examined through a critical point of view by doing exercises on understanding, telling, reading, and writing. Punctuation and spelling rules, which are basis of written statement, will be taught and accurate usage of these rules for efficient and strong expression will be provided.

This is a compulsory English course which provides basic language skills such as reading, writing, listening and speaking at the beginning level.

Applying the rules and principles of accounting, students will be able to prepare year-end balance sheets and income statement, make accounting entries to liability accounts.

Internship, covers field experience at any work place. Students should follow the instructions stated in IUE Internship Guide in order to successfully complete their internships.

This course consists of determining the concept of merchandise and commercial judgement, the commercial book, unfair competition and partnership operations, the negotiable ınstruments.

Students will be taught how to use the written communication tools accurately and efficiently in this course. There will be exercises on understanding, telling, reading, and writing; types of speeches (panel, symposium, conference, etc.) will be introduced; the student will be equipped with information on using body language, accent and intonation, and presentation techniques.

With special reference to the Principals of Atatürk the course will examine the philosophy of the foundation and existence of the republican regime as well as the democratic developments in secular Turkey during the twentieth century and in the era of extending globalization.

This course includes the explanation of macroeconomic terms, and the analysis of general economic conjuncture in unemployment and national income headings.

Student will be able to identify and calculate all cost elements including raw materials and supplies, labor costs and manufacturing overhead costs.

Implementation of accounting transactions by using computer software programs

Tax law, taxation principles, taxation procedure

Basic concepts and principles of labour law, rights and obligations of employers and employees within the context of labour contract, cancellation fo labour contract and legal results, basic concepts and principles of collective labour law, concept of social security law, Turkish social security law and branches of social insurances, general health insurance.

Having the relevant and detailed information about the financial investment tools, the students will be able to identify the Turkish Tax system including the information about the rights and obligations of the taxpayer and information required to be able to calculate the tax liability considering the exemptions, exceptions and the tax limits.

Internship, covers field experience at any work place. Students should follow the instructions stated in IUE Internship Guide in order to successfully complete their internships.

Having the relevant and detailed information about the financial investment tools, the students will be able to identify the types of each tools for financing, understand the functioning of the related markets and make financial decisions among financial investments tools considering the advantages and disadvantages of each.

Having the relevant and detailed information about the each type of financial statements and the methods for financial analysis the students will be able to draw useful and appropriate conclusions from the information obtained from financial statements.

The students will identify the commercial software programs and will make transactions of cash, banks, invoices, checks, bills, inventory and current accounts by using software programs.

Elective Courses

BNK 127 Investment Analysis and Portfolio Management

Students will learn basic concepts of investment analysis and portfolio management, also they will learn the methods of giving dynamic investment decisions based on the market conditions .

ETR 101 E-Trade

This course aims to teach planning of electronic commerce activities and trading on internet.

MINT 230 Professional Ethics

To analyze the concepts of ethics and morality. To analyze the concepts of ethics and morality. To analyze the ethics systems. To examine the concept of social responsibility.

MMAT 111 Professional Mathematics

The students who succeeded in this course will be able to do the calculations about sets and numbers correctly and apply these into their professions. They will be able to make basic set operations correctly and will be able to make basic number operations correctly.

MMAT 112 Business Mathematics

Commercial mathematical applications. Percent and per mille calculations. Ratio and proportion.

MTOI 220 Coaching, Leadership and Career Management

Basic Coaching Information, Coaching and Leadership Competencies, Leadership Styles, Values and Its Importance in Coaching, Effective Expression and Communication Techniques, Recognition and Application of Coaching Tools will be covered in the lecture.

MUH 104 Public Finance

Topics such as public finance, public expenditures and incomes, principles and boundaries of taxation and effects on the economy, taxation systems and government debts will be covered.

MUH 209 Foreign Trade Operations

With this course, student will be able to identify and prepare foreign trade documents such as shipping documents, movement certificates and others.

MUH 210 Accounting for Foreign Trade Transactions

This course covers subjects as accounting records of import and export transactions, accounting records for VAT Applications resulting from import and export transactions, accounting records of foreign currency transactions and letter of credit transactions.

MUH 220 Inventory Operations

Students will be able to manage accounting records for the end of the accounting period and will be able to prepare basic financial statements, such as balance sheet and income statement.

MUH 221 Corporate Accounting

Students will be able to identify corporations according to their distinctive characteristics. Considering the to the rules and regulations, students will be able to manage accounting transactions related to the circumstances such as setting up a company, change in capital amount, dividend payment and liquidation of a company.

MUH 230 Bank Accounting

This course covers uniform chart of accounts, accounting journals and documents used in banks, accounting records related to deposits, accounting records related to loans, treasury bills, repo and reverse repo transaction records, provisions, taxes, accounting records related to shareholders' equity and use of income & expense accounts.

MUH 240 International Accounting Standards

This course includes; The purpose of the international accounting standards, international accounting standards board, the development of international accounting standards , elements of international accounting standards, the accounting process according to international accounting standards.

MUH 250 Accounting Control

This course includes topics such as internal control structure, audit evidence, cycle approach in audit, assurance services, audit risk.

MUH 260 Construction for Accounting

Contents of this course include cost systems in construction accounting, taxation and accounting for construction costs spread over years/ months, accounting applications in floor construction contracts.

MUH 270 Financial Management

Having the relevant and detailed information about the financial management, the students will be able to use various methods which are useful for making financial decisions such as capital structure, working capital and investment projects. The students will also be able to analyze and evaluate the performance of the companies.

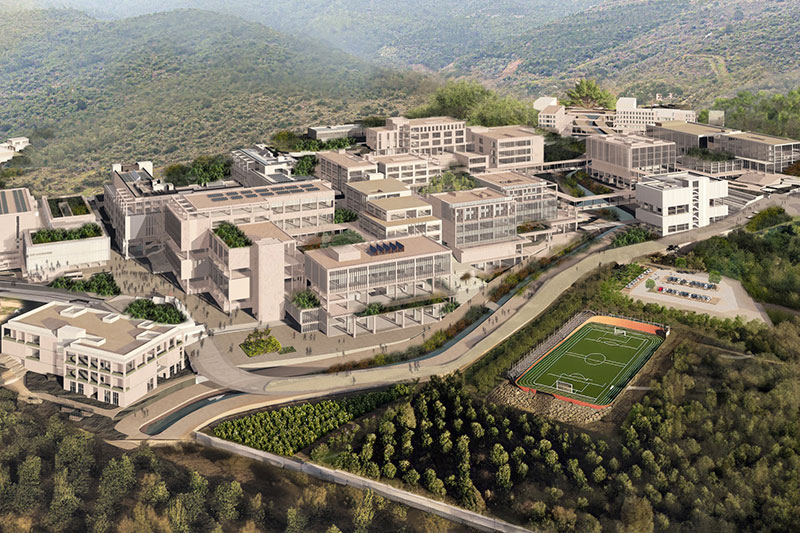

IZMIR UNIVERSITY OF ECONOMICS GÜZELBAHÇE CAMPUS

DetailsGLOBAL CAREER

As Izmir University of Economics transforms into a world-class university, it also raises successful young people with global competence.

More..CONTRIBUTION TO SCIENCE

Izmir University of Economics produces qualified knowledge and competent technologies.

More..VALUING PEOPLE

Izmir University of Economics sees producing social benefit as its reason for existence.

More..